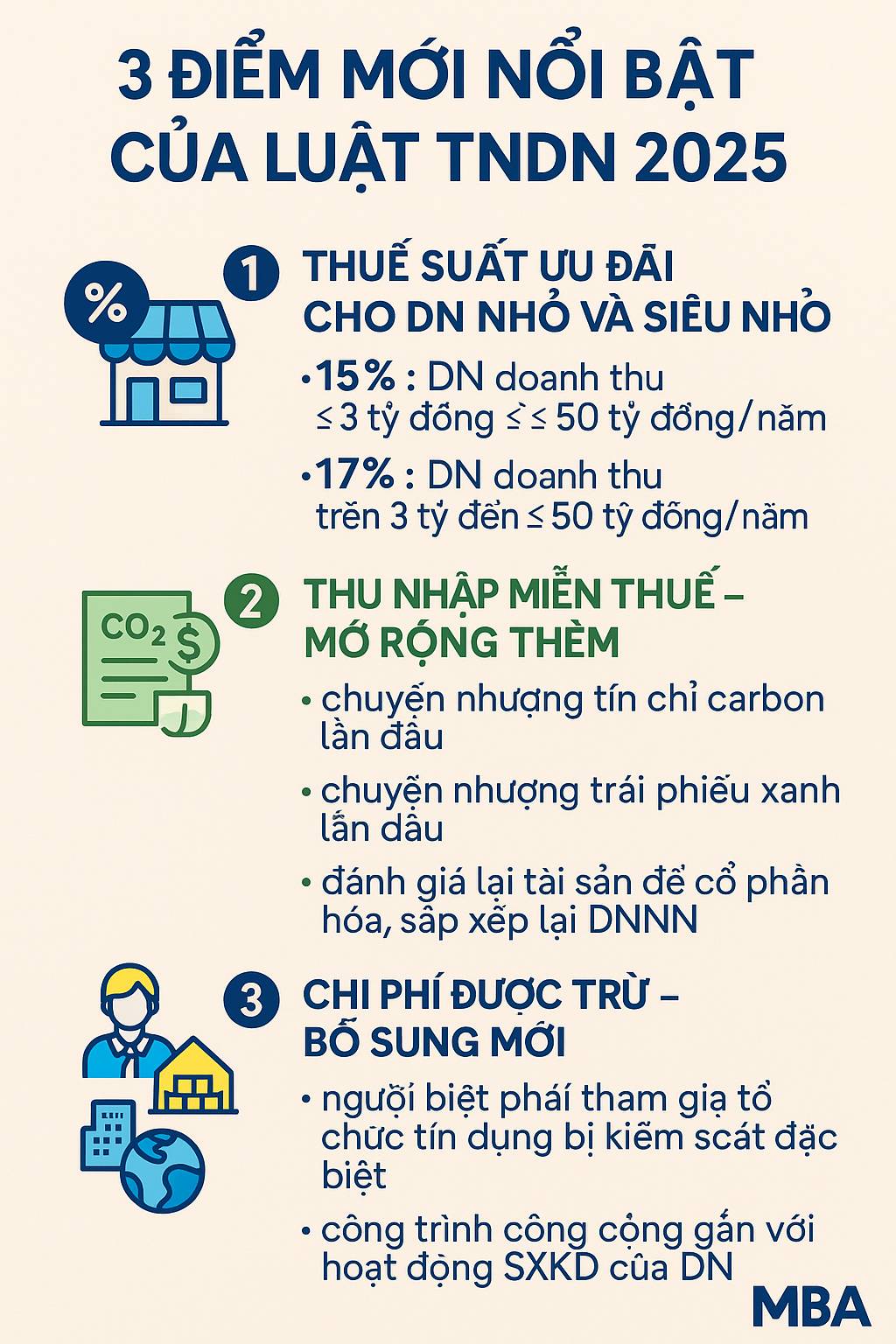

🔵 Key Highlights of the 2025 Corporate Income Tax Law

On June 14, 2025, the National Assembly passed the Corporate Income Tax Law No. 67/2025/QH15, effective from October 1, 2025, applicable for the 2025 tax year. According to Official Letter 849/DLA-NVDTPC (September 18, 2025) from Dak Lak Tax Department, here are the key new points:

1️⃣ Preferential Tax Rates for Small & Micro Enterprises

- 15% Enterprises with annual revenue ≤ VND 3 billion.

- 17% Enterprises with annual revenue > VND 3 billion to ≤ VND 50 billion.

👉 This is a direct support policy, reducing tax burdens and creating more room for reinvestment in small businesses.

2️⃣ Expanded Tax-Exempt Income

- Income from the first transfer of carbon credits.

- Income from the first transfer of green bonds.

- Valuation differences arising from asset revaluation for equitization and restructuring of state-owned enterprises.

3️⃣ Newly Deductible Expenses

- Expenses for seconded personnel involved in managing and operating credit institutions under special supervision.

- Some expenses serving business operations even if not directly tied to revenue in the same period.

- Expenses for supporting the construction of public works linked to the enterprise’s business activities.

- Expenses related to greenhouse gas emission reduction.

📌 Conclusion

The 2025 Corporate Income Tax Law not only tightens tax management but also encourages green innovation – sustainable development – support for small businesses.

💬 Has your business prepared for the 2025 corporate income tax year?

Xem thêm

- Procedures for tax declaration, settlement and refund apply from September 3, 2025

- ⏰ Overtime from 200-300 hours/year – What should businesses pay attention to?

- Decree 228/2025/ND-CP – Mandatory Audited Financial Statements

- Decree 70/2025 on Invoices and Documents: Key Updates to Note

- INDIVIDUALS RENTING HOUSES – BUSINESSES NEED TO PAY ATTENTION