📌 Late Payment — Can You Re-Claim Input VAT Deduction?

Effective 01/07/2025 (per Decree 181/2025/ND-CP): if a business misses the contractual payment deadline, it loses the right to deduct input VAT for that purchase and cannot claim it back later.

1) New Rules from 01/07/2025

- For deferred/installment purchases of ≥ VND 5 million, input VAT is deductible only when you have:

- ✅ A written sales contract;

- ✅ A valid VAT invoice;

- ✅ Non-cash payment evidence (bank transfer, netting of payables, etc.).

- Before the contractual due date → the business may temporarily deduct input VAT.

- At the due date without non-cash payment evidence → the business must adjust and reduce the previously deducted input VAT.

2) The Shocking Catch

❌ After you have adjusted and reduced the input VAT at the due date, even if you pay later with valid evidence, you still:

cannot re-deduct that input VAT.

cannot re-deduct that input VAT.

In short: a late payment permanently forfeits the right to deduct the input VAT you initially claimed.

3) Practical Example

Company A purchases equipment worth VND 2,000,000,000 + VND 200,000,000 VAT.

- Contractual payment due date: 30/09/2025.

- No transfer made by the due date → must reverse the VND 200,000,000 input VAT.

- Payment finally made via bank in Nov 2025 → still no right to re-deduct that VND 200,000,000.

Result: the company loses the deduction and overall tax cost increases.

4) What Should Businesses Do?

- ✅ Rigorously track due dates per contract/appendix.

- ✅ Monitor payables & VAT with software; enable pre-due alerts.

- ✅ Prioritize on-time bank transfers to preserve the deduction.

- ✅ When negotiating deferred terms, set realistic timelines to avoid “trapped” VAT.

5) Key Takeaways

From 01/07/2025:

- 🔎 On-time payment = you keep the input VAT deduction.

- 🔎 Late payment = you permanently lose the deduction (no re-claim later).

👉 Review all deferred-payment contracts now to prevent VAT leakage caused by missed deadlines.

Advisory & Support

📞 MBA Audit Firm can help you:

- Review payables and tax clauses in contracts,

- Design an input-VAT control system,

- Mitigate risks under Decree 181/2025/ND-CP.

✨ MBA Audit Firm – Trust. Integrity. Professionalism.

Xem thêm

- Decree 228/2025/ND-CP – Mandatory Audited Financial Statements

- Fines of VND 10–20 Million for Failing to Issue E-Invoices Per Sale

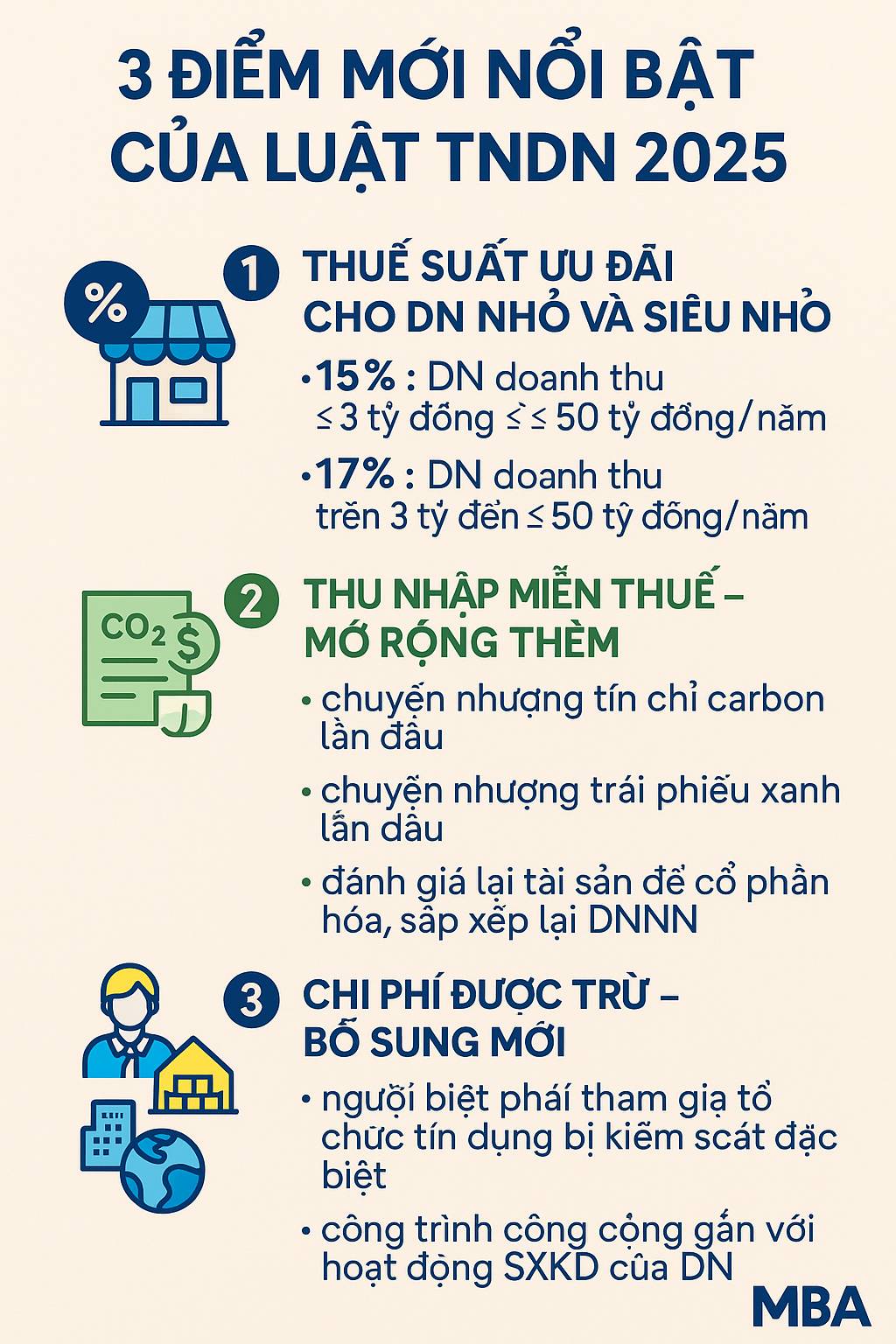

- 🔵 Key Highlights of the 2025 Corporate Income Tax Law

- Decree 70/2025 on Invoices and Documents: Key Updates to Note

- Procedures for tax declaration, settlement and refund apply from September 3, 2025