From Presumptive Tax to Self-Declaration: Tax Q&A for Household Businesses

Source: baochinhphu.vn

Starting from June 1, 2025, the application of e-invoices generated from cash registers for household businesses with annual revenue over VND 1 billion is considered an appropriate policy. However, many households are still confused and need clear guidance. The Tax Department and experts have provided specific and transparent answers to frequently asked questions.

Question 1:

A household producing shoes with annual revenue under VND 1 billion asked: When a customer requests an invoice, what type should be issued? And how should the input VAT (8%) and output VAT (4.5%) be handled?

Answer: According to Ms. Nguyễn Thị Cúc – Chairwoman of the Vietnam Tax Consultants’ Association, since the household is under presumptive tax, issuing an invoice means paying an additional 4.5% tax. However, input VAT is not deductible. It is recommended to convert into an enterprise to benefit from input VAT deduction and a 5-year loss carryforward policy.

Question 2:

A café and F&B business with over VND 1 billion in annual revenue asked whether they must immediately switch to tax declaration.

Answer: From June 1, 2025, such households must apply e-invoices from cash registers, and revenue determination will be adjusted accordingly.

Question 3:

Many households asked whether accounting standards should be established for households to enable VAT deduction like enterprises, especially since they are small-scale and lack staff, yet are taxed based on revenue and easily incur losses.

Answer: Ms. Cúc explained that by law, legal entities (enterprises) pay corporate income tax (CIT), while individuals pay personal income tax (PIT). Households cannot pay CIT. Although there was a previous approach to PIT based on revenue minus expenses, it was ineffective due to lack of bookkeeping. Still, she supports developing accounting standards for households to enhance transparency and feasibility.

Question 4:

Some households expressed concern about working hard but still having to pay multiple taxes.

Answer: The Ministry of Finance is drafting a revised PIT Law, increasing the family deduction and adjusting tax brackets. Additionally, household businesses converting to enterprises will enjoy CIT exemptions for the first 3 years and preferential rates of 15–17% afterward.

Question 5:

Concerns were raised about using e-invoices when inventory lacks legal input invoices or involves resold goods.

Answer: From June 1, 2025, household businesses with revenue over VND 1 billion and those using cash registers must apply e-invoices transmitted in real-time to tax authorities. Regarding inventory without invoices, as long as it is not illegal or smuggled goods, tax is based on selling revenue. There will be no retroactive tax collection unless tax evasion is detected.

Question 6:

Many households worry about lacking accounting skills or not knowing how to file taxes.

Answer: Ms. Đinh Thị Thúy, MISA representative, introduced OneApp – an integrated software for sales, invoicing, and tax filing that works on smartphones with simple steps. MISA also offers support via 4,000+ certified tax agents with 3-month free consultation for households.

Question 7:

Do households already using traditional e-invoices need to switch to cash-register e-invoices?

Answer: Yes, if they have not generated invoices from cash registers yet. MISA offers free conversion for their customers to comply with current regulations.

Question 8:

What if the business involves handmade cosmetics, agricultural products, or fresh food without input invoices?

Answer: Ms. Cúc advised creating purchase statements from farmers or individuals with full information, payment amount, and signatures, which can be accepted for accounting purposes. For small businesses like nail salons earning under VND 100 million/year, per Circular 40/2021/TT-BTC, they are exempt from VAT and PIT and are not required to issue e-invoices, but honest declaration is necessary.

Question 9:

A pig-raising household in Thanh Hoa asked how to handle input from farmers and how to issue invoices when selling a few times a year.

Answer: Unprocessed livestock products are VAT-exempt, and the household is also PIT-exempt. Inputs can be documented using purchase statements from farmers as per regulation.

Question 10:

A restaurant household in Sam Son is considering converting to an enterprise.

Answer: Benefits include VAT deduction for inputs (electricity, water, ingredients…), deductible operating costs (staff, rent, marketing…), and 5-year loss carryforward. Small enterprises can enjoy a 3-year CIT exemption. Concerns like hiring an accountant or dealing with inspections are mitigated by free accounting software for micro-enterprises and the option to hire tax agents. Regular compliance minimizes inspection risks.

Conclusion:

Experts concluded that in the long term, transitioning into an enterprise will help household businesses become more transparent, expand their markets, and fully benefit from favorable tax policies.

Tax Policy Transition Timeline

At a national online conference, Mr. Mai Son – Deputy Director of the General Department of Taxation – emphasized: According to Decree 70/2025/ND-CP and Resolution 68-NQ/TW, the presumptive tax regime will be completely abolished by January 1, 2026, replaced with self-declaration and payment based on actual revenue. This move aims at a transparent, modern, and sustainable tax environment.

The tax sector has built a comprehensive support network, from provincial to district levels, offering:

- eTax Mobile invoice registration guidance

- Clarification of legal and technical provisions

- Answers to practical issues such as applicable entities, invoice issuance without full customer info, equipment costs, accounting standards, and compliance penalties

Need Help?

If you still have questions, contact our tax experts for thorough and accurate support.

MBA Audit Firm specializes in serving foreign investors and businesses planning to operate in Vietnam. We provide fully compliant accounting and tax services. As one of the few firms legally licensed in this field, we are committed to professional, accurate, and efficient service.

Accounting is a vital part of every business. MBA offers professional and competent outsourced accounting services. With our dedicated, fast, and reliable accounting support, we are your trusted partner in sustainable business growth.

Contact us today for a consultation and experience the best accounting services!

- Decree 228/2025/ND-CP – Mandatory Audited Financial Statements

- VAT Changes in Vietnam After July 1, 2025 – What Businesses Must Know

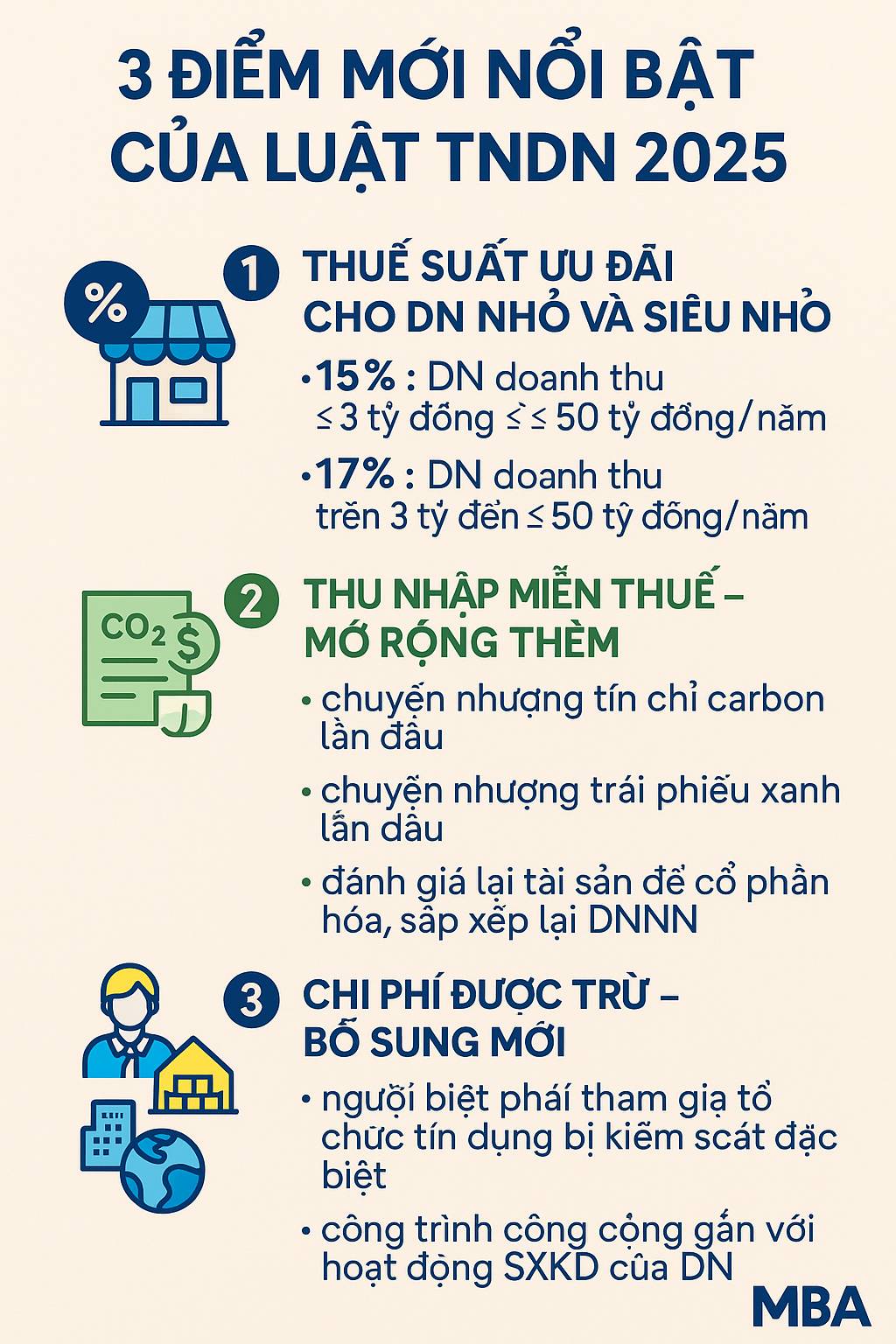

- 🔵 Key Highlights of the 2025 Corporate Income Tax Law

- Procedures for tax declaration, settlement and refund apply from September 3, 2025

- 📌 E-Invoices: Key Updates Effective from 01/06/2025