📌 E-Invoices: Key Updates Effective from 01/06/2025

On 01/06/2025, Decree 70/2025/ND-CP takes effect, amending important provisions of Decree 123/2020/ND-CP on e-invoices. This is a step toward greater transparency, tighter tax management, and support for businesses in the digital economy.

1️⃣ New Subjects & Concepts

- Foreign suppliers (e-commerce, digital platforms) may voluntarily register to use e-invoices.

- New concepts introduced: “E-commerce invoice” and “E-invoice generated from cash registers”.

- A new Tax Authority E-Invoice Portal for e-invoice management.

2️⃣ New Rules on Issuance & Usage

- Integration of receipts & invoices allowed when collecting taxes, fees, charges, and services together.

- More cases requiring invoices for each transaction (casinos, gaming with prizes, e-commerce, etc.).

- Revised timing of invoice issuance for specific industries: insurance, export, lottery, healthcare, etc.

- VAT invoice cum tax refund form officially implemented.

3️⃣ Data Management & Security

- Mandatory submission of e-invoice data to tax authorities; failure to submit is a violation.

- Stricter registration with biometric technology to enhance security.

- Additional responsibilities for e-invoice service providers.

4️⃣ Impact on Businesses

- Improved legal framework for e-commerce and digital businesses.

- Stronger tax control → reduced invoice fraud risks.

- Simplified procedures: registration, authorization, electronic records.

- Covers more industries: e-commerce, casinos, insurance, healthcare, education…

🎯 Conclusion

Decree 70/2025/ND-CP demonstrates the Government’s effort to modernize the e-invoice system, ensuring transparency – security – efficiency.

👉 Businesses should: update the new rules promptly, review invoicing processes, prepare IT infrastructure, and coordinate with tax authorities/service providers.

📞 Contact MBA Audit Firm for detailed advisory and internal training on e-invoice compliance.

✨ MBA Audit Firm – Trust. Integrity. Professionalism.

Xem thêm

- Tax Obligations for Individuals – Household Businesses – Small Enterprises

- Decree 70/2025 on Invoices and Documents: Key Updates to Note

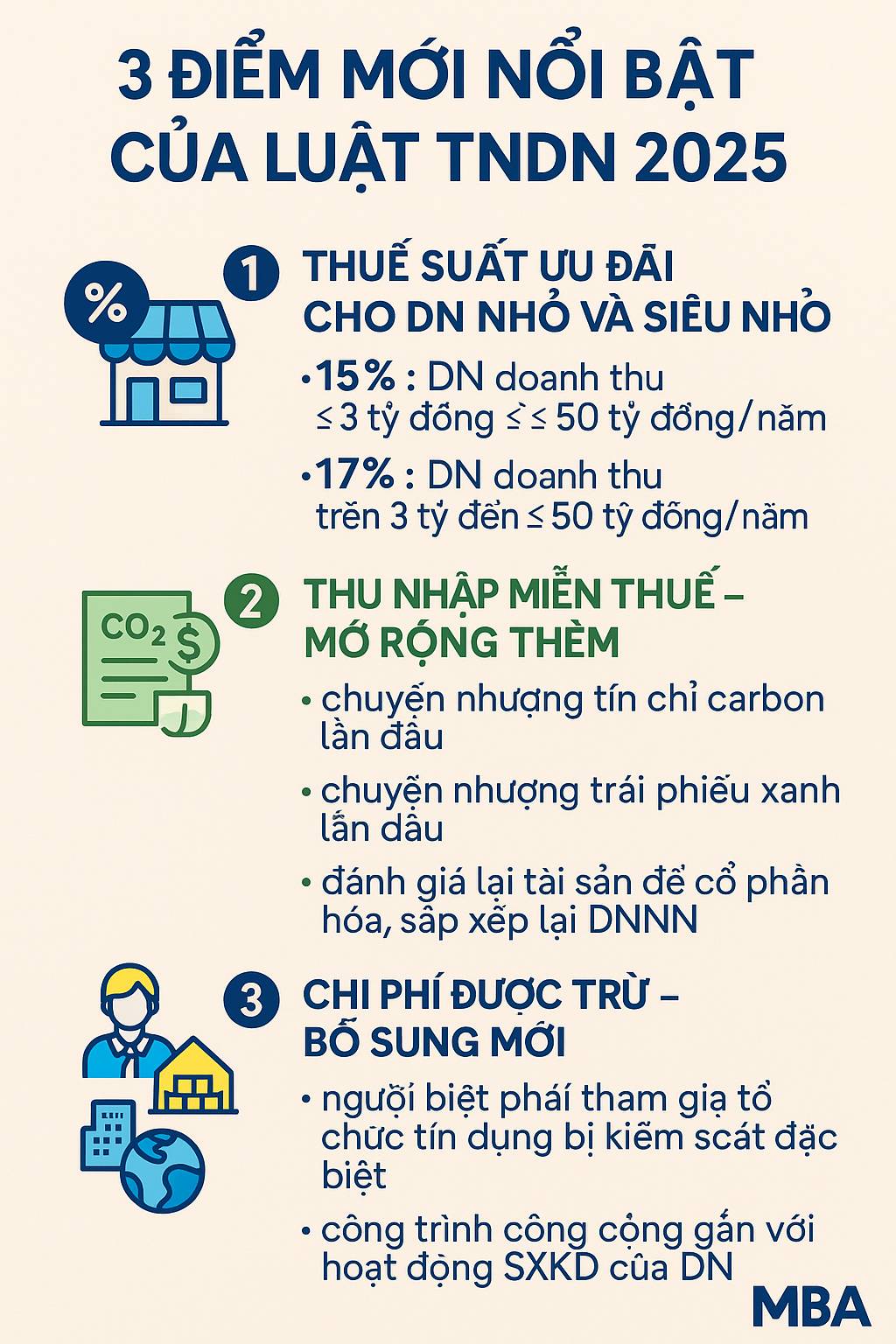

- 🔵 Key Highlights of the 2025 Corporate Income Tax Law

- VAT Changes in Vietnam After July 1, 2025 – What Businesses Must Know

- Good News from the Corporate Income Tax Law 2025