Small & Medium Enterprises: Good News from the Corporate Income Tax Law 2025

On 14/06/2025, the National Assembly passed Law No. 67/2025/QH15, effective from 01/10/2025.

The new law introduces not just rates but also clear directions: stronger support for SMEs, incentives for high-tech–green economy–innovation, and updated rules for the digital economy.

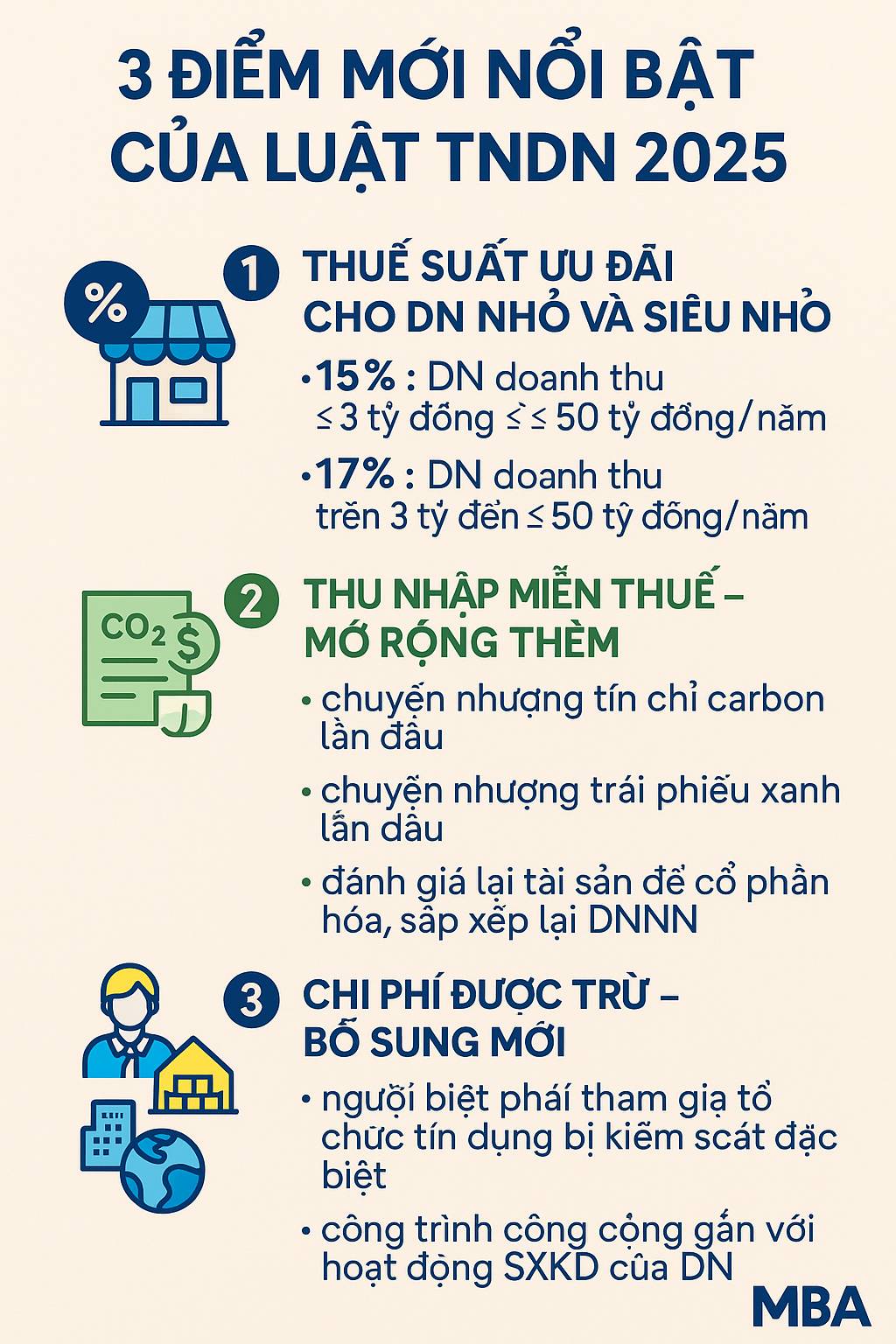

1) Tiered CIT rates – Real relief for SMEs

| Revenue | CIT Rate |

|---|---|

| ≤ 3 billion VND/year | 15% |

| >3 to ≤50 billion VND/year | 17% |

| General | 20% |

Meaning: the smaller the business, the lower the burden – more room for reinvestment.

Note: Not applicable to subsidiaries or linked companies failing conditions. Newly established firms converted from household businesses enjoy 2 years of CIT exemption.

2) Strong incentives for strategic sectors

- High-tech, digital economy, semiconductors, AI → 10% for 15 years; 4-year exemption; 50% reduction for next 9 years.

- Agriculture, forestry, fisheries → 10% (or 15% if outside incentive zones).

- Renewable energy, manufacturing, environment → 10% for 15 years.

- Key infrastructure, social housing → 10%.

- Education, healthcare, press, publishing → 10%.

3) Tighter taxation on digital economy & foreign suppliers

- Foreign enterprises without permanent establishments in VN (e-commerce, digital platforms) still subject to CIT.

- Definition of “permanent establishment” broadened to include digital platforms.

- Aim: create fairer competition between domestic and cross-border businesses.

4) Flexible transition provisions

- Enterprises can choose to apply incentives per original investment license or under the new Law (if eligible).

- If previously ineligible but now qualified under the new Law, incentives apply from tax year 2025 onwards for the remaining term.

✅ What should businesses do now?

- Review 2024 revenue to determine CIT tier (15%–17%–20%).

- Check if your sector falls under new incentives (AI, semiconductors, green energy…).

- Review contracts with foreign suppliers → avoid risk of being deemed a “permanent establishment”.

- Compare current license with new Law to select the most beneficial regime.

- Prepare CIT planning for 2025 early.

Xem thêm

- Fines of VND 10–20 Million for Failing to Issue E-Invoices Per Sale

- Decree 228/2025/ND-CP – Mandatory Audited Financial Statements

- INDIVIDUALS RENTING HOUSES – BUSINESSES NEED TO PAY ATTENTION

- Late Payment — Can You Re-Claim Input VAT Deduction?

- ⏰ Overtime from 200-300 hours/year – What should businesses pay attention to?