Tax Obligations for Individuals – Household Businesses – Small Enterprises

(Updated regulations effective from June 2025)

Comparison Table of Tax Obligations

Applicable in the case of real estate rental by individuals, household businesses, and small enterprises

(Criteria based on Article 5, Decree 80/2021/ND-CP on classification of small enterprises).

| No. | Criteria | Individual | Household Business | Small Enterprise |

|---|---|---|---|---|

| 1 | Business Registration | Not required | Required | Required |

| 2 | VAT | 5% if revenue > VND 100M/year (VND 200M from Jan 1, 2026) |

5% if revenue > VND 100M/year (VND 200M from Jan 1, 2026) |

10% (deductible method) Input VAT can be deducted if eligible |

| 3 | Personal / Corporate Income Tax | 5% PIT if revenue > VND 100M/year | 2% PIT if revenue > VND 100M/year | 20% CIT on net profit (Exempt for first 3 years under Resolution 68) |

| 4 | License Fee | Applicable if revenue > VND 100M/year | Applicable if revenue > VND 100M/year | Based on charter capital |

| 5 | Tax Calculation Method | Per contract | Flat-rate or annual revenue declaration | Based on accounting records |

| 6 | Expense Deductibility | Not allowed | Limited | Allowed (if documents are valid) |

| 7 | Legal Recognition & Reputation | Low | Medium | High |

| 8 | Accounting Procedures | Simple | Moderate | Complex (requires accountant) |

| 9 | Suitable Business Model | Small-scale rental | Multiple property rental | Large-scale operations |

📌 Tax Exemption Note

According to Clause 2, Article 4 of Circular 40/2021/TT-BTC: Individuals and household businesses with total annual revenue ≤ VND 100 million

are exempt from VAT and PIT. However, they must still declare tax accurately and on time, and bear responsibility for the accuracy of their declarations.

🔍 Example: Annual Revenue of VND 600 million

| Entity Type | Revenue (million VND) | Taxes | Total Tax Payable |

|---|---|---|---|

| Individual | 600 |

VAT: 5% = 30 PIT: 5% = 30 License fee: 0.5 |

60.5 million |

| Household Business | 600 |

VAT: 5% = 30 PIT: 2% = 12 License fee: 1 |

43 million |

| Small Enterprise | 600 |

VAT: 10% = 60 (deductible) CIT: 20% of profit (e.g. profit = 50 => CIT = 10) License fee: 2 |

72 million (Subject to change depending on input VAT and actual profit) |

Note: When considering a business’s tax number, it is necessary to clearly plan the related costs to be able to visualize the most accurate tax number.

Xem thêm

- Fines of VND 10–20 Million for Failing to Issue E-Invoices Per Sale

- Decree 228/2025/ND-CP – Mandatory Audited Financial Statements

- ⏰ Overtime from 200-300 hours/year – What should businesses pay attention to?

- 📌 E-Invoices: Key Updates Effective from 01/06/2025

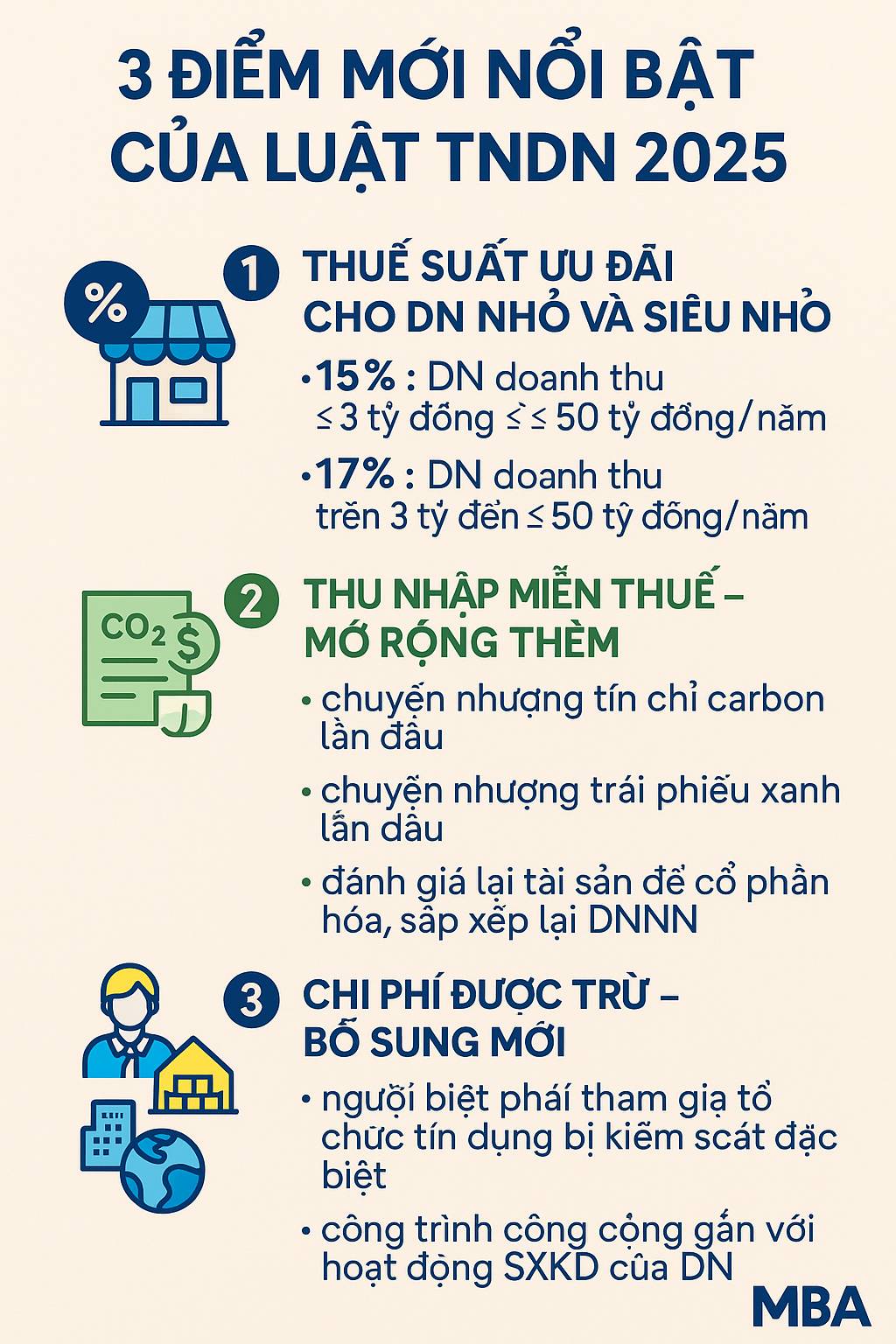

- 🔵 Key Highlights of the 2025 Corporate Income Tax Law