⚖️ Decree 228/2025/ND-CP • Mandatory Audited Financial Statements

Enterprises subject to mandatory annual audit of financial statements – “Heavy” penalties

Effective from 18/08/2025, Decree 228/2025/ND-CP tightens mandatory audits. Violations may incur administrative fines of up to VND 400 million.

Effective date: 18/08/2025

Maximum penalty: VND 400 million

Maximum penalty: VND 400 million

1️⃣

Wrong selection of audit firm (Article 27)

VND 20–30 mil

Hiring an audit firm without legal eligibility.

VND 30–40 mil

Hiring an audit firm without professional capacity.

VND 40–50 mil

Failure to conduct the mandatory audit of FS.

👉 A common mistake: selecting a small firm without proper license → audit report rejected.

2️⃣

Audit contract non-compliance (Article 28)

VND 5–10 mil

Contract missing mandatory contents.

VND 10–20 mil

Contract signed late.

VND 30–40 mil

Contract signed after audit work has been performed.

VND 40–60 mil

No contract signed but audit still conducted.

⚠️ Tax authorities & the SSC will review contracts. Any deficiency = immediate fine.

3️⃣

Violations during the audit process (Article 29)

VND 20–30 mil

Explanations incomplete or late.

VND 40–60 mil

Failure to explain upon request.

VND 60–80 mil

Engaging a person not qualified to sign the audit report.

VND 80–100 mil

Refusal to provide necessary information/documents.

VND 100–200 mil

Bribery, collusion, concealment, obstruction, misrepresentation.

VND 200–400 mil

Repeat violations (from the second time onwards).

✅ Prevention checklist

- ✓Select audit firms fully eligible (per MOF list).

- ✓Ensure complete terms and sign before the engagement starts.

- ✓Prepare support files: contracts, vouchers, minutes, significant transactions.

- ✓Archive digital & hard copies for at least 10 years.

- ✓Train in-house accountants: “5-minute check – avoid fines”.

🎯 Expert message

“Compliance with Decree 228/2025/ND-CP is a legal shield and a trust key for capital markets, banks, and regulators.”

Need a Decree-228 compliant audit contract & process checklist?

MBA Audit offers a free first-session review of contract templates, SOP archiving, and explanation scenarios.

✨ MBA Audit Firm – Prestige • Integrity • Professionalism

Hotline/Zalo: 0984 844 099 • Email: kinhdoanh@mba-au.com

Xem thêm

- Tax Q&A for Household Businesses

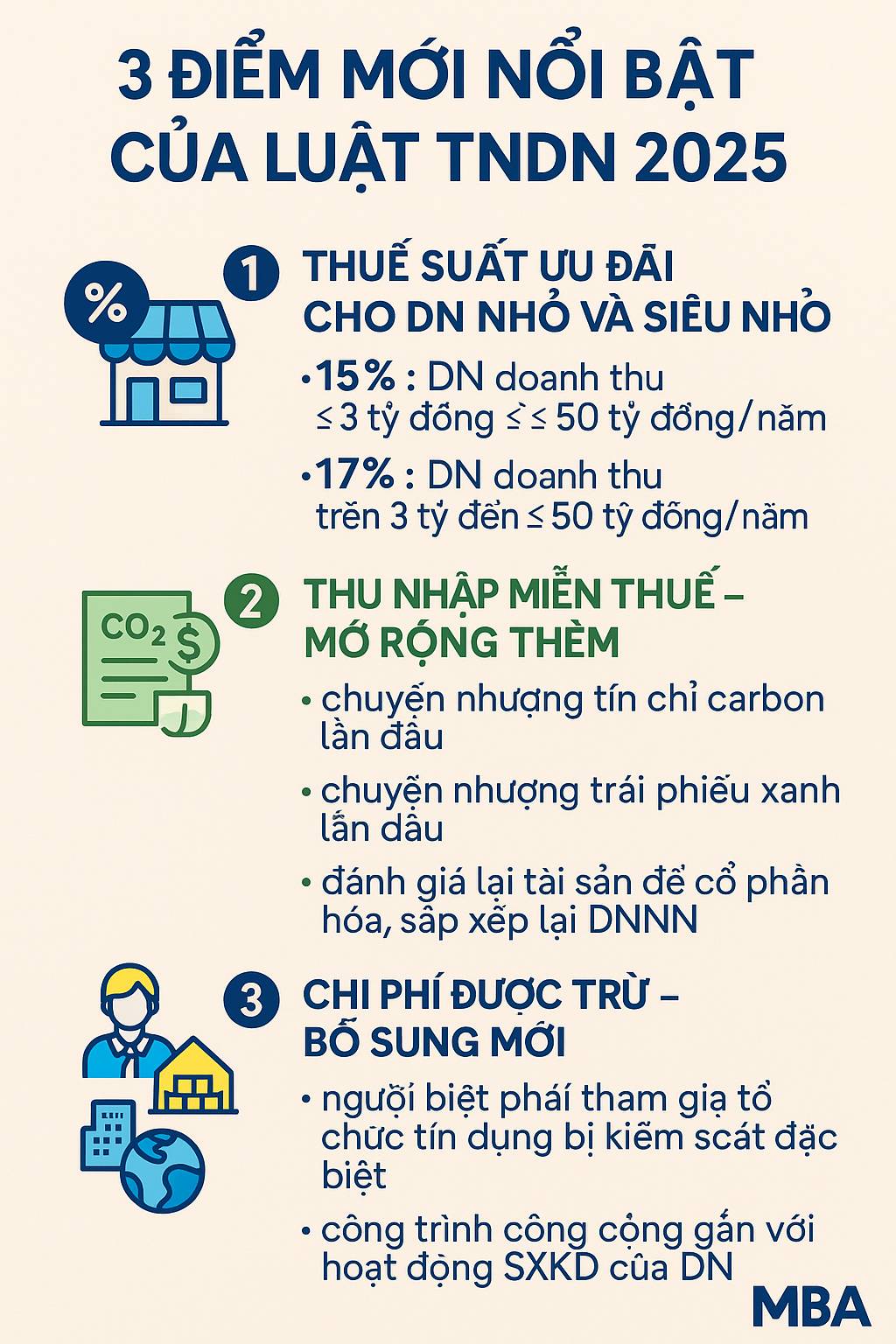

- 🔵 Key Highlights of the 2025 Corporate Income Tax Law

- Decree 70/2025 on Invoices and Documents: Key Updates to Note

- ⏰ Overtime from 200-300 hours/year – What should businesses pay attention to?

- Tax Obligations for Individuals – Household Businesses – Small Enterprises